48+ can i deduct mortgage interest on a second home

Best Mortgage Refinance Compared Reviewed. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Keep The Mortgage For The Home Mortgage Interest Deduction

Web Generally for the first and second categories you can deduct mortgage interest on up to 1 million 500000 for those married filing separately.

. In fact unlike the mortgage interest rule you can deduct property taxes paid on any number of homes. Apply Get Pre Approved In 24hrs. Web You cant deduct home mortgage interest unless the following conditions are met.

You must use it. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every. Web You can deduct property taxes on your second home too.

Refinance Today Save Money By Lowering Your Rates. Your Loan Should Too. Youre allowed to deduct the interest on a loan secured by your main home where you ordinarily live most of the time and a second home.

Web You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest. If you rent out your second home you must also use it as a home during the year. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. For taxpayers who use. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web The mortgage interest deduction is a tax incentive for homeowners. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Web Points you pay on a mortgage for a second home can only be deducted over the loans life not in the year you pay them however. Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible. Homeowners who bought houses before December 16.

Web The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a home loan in a given tax year lowering their total. This itemized deduction allows homeowners to subtract mortgage interest from their taxable. Web Deducting mortgage interest on second homes If you have two homes you can still deduct the mortgage interest on your federal taxes on a second home.

You file Form 1040 or 1040-SR and itemize deductions on Schedule A Form 1040. Web If your total principal amount outstanding is 750000 375000 if married filing separately or less you can deduct the full amount of interest paid on all mortgages for a main or. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Deducting Mortgage Interest On A Second Home Pocketsense

Tax Advantages Of Limited Partnerships

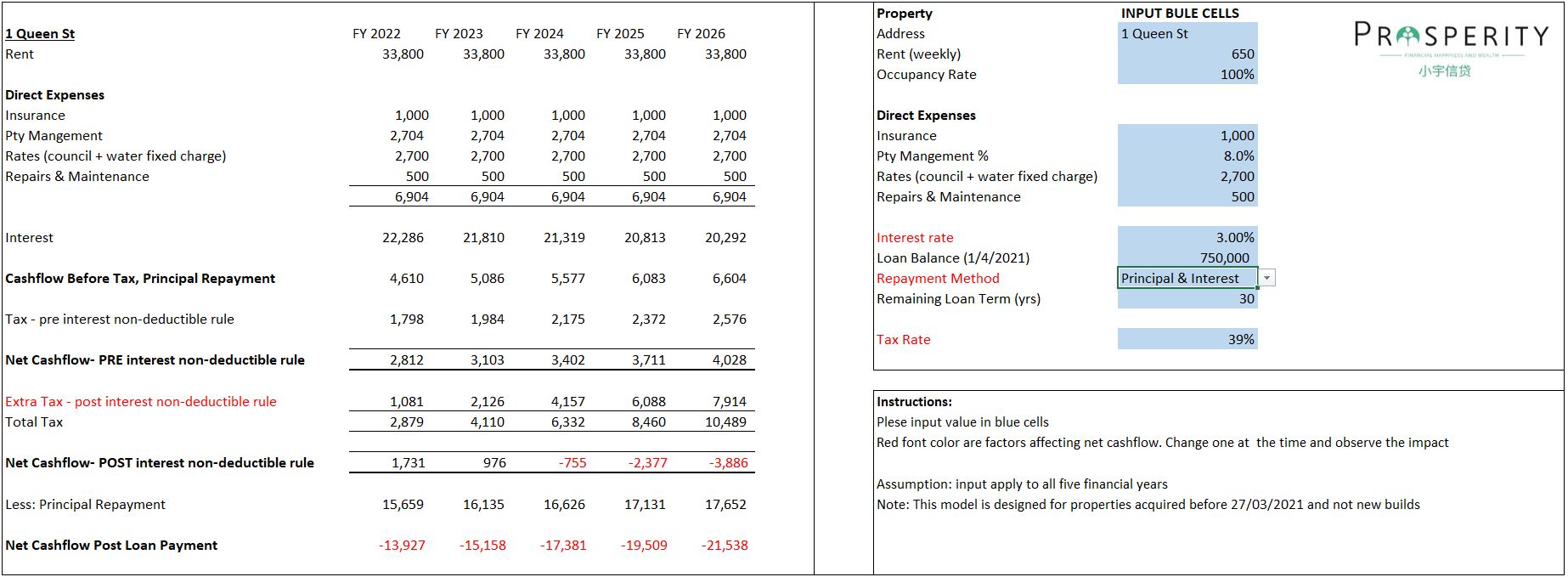

New Housing Policy 2021 No Interest Deductions On Residential Rental Property

Can I Take The Home Mortgage Interest Deduction On More Than One House

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Second Homes And The Mortgage Interest Deduction Brighton Jones

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

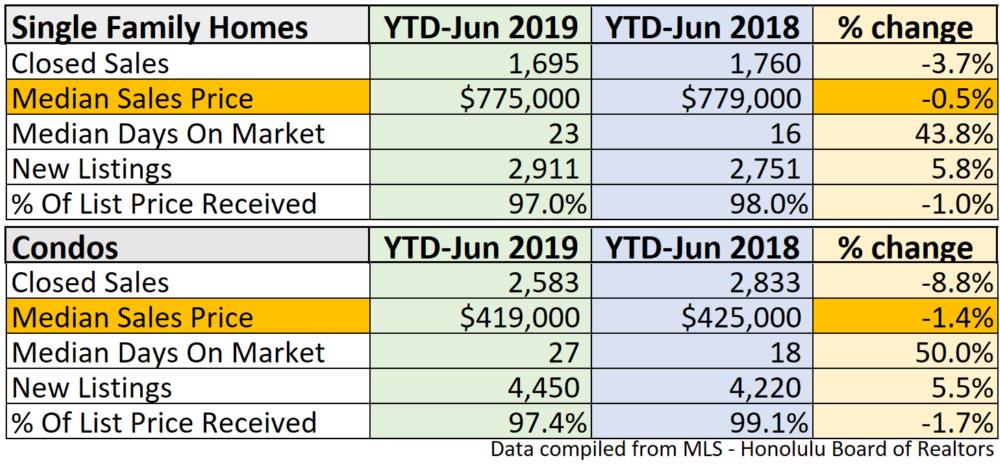

Oahu Real Estate Market Update 2019 Mid Year Oahu Real Estate Blog Outstanding Info

Second Mortgage Tax Benefits Complete Guide 2023

Smoky Mountain News June 2 2021 By Smoky Mountain News Issuu

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Oahu Real Estate Market Update 2019 Mid Year Oahu Real Estate Blog Outstanding Info

Can You Deduct Mortgage Interest On A Second Home Moneytips

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

8 Great Reasons To Sell Your Home This Winter

Second Home Tax Deductions Tax Tips For Homeowners